The Techjoomla Blog

JGive 2.3 introduces donor data management & 80G tax benefit certificate

Efficient organization and management of donor data and building long-term relationships with donors is crucial for the success of any fundraising campaign. Donor management is the key to donor retention. Donor retention goes a long way in increasing the returns for any fundraising campaign.

Till now, JGive did not explicitly manage the Donor as a separate entity. It was simply Billing information filled at checkout. With JGive v2.3 we introduce a feature called Donor Data management that lets you manage the data of Individual and Organizational Donors.

Donor Data Management

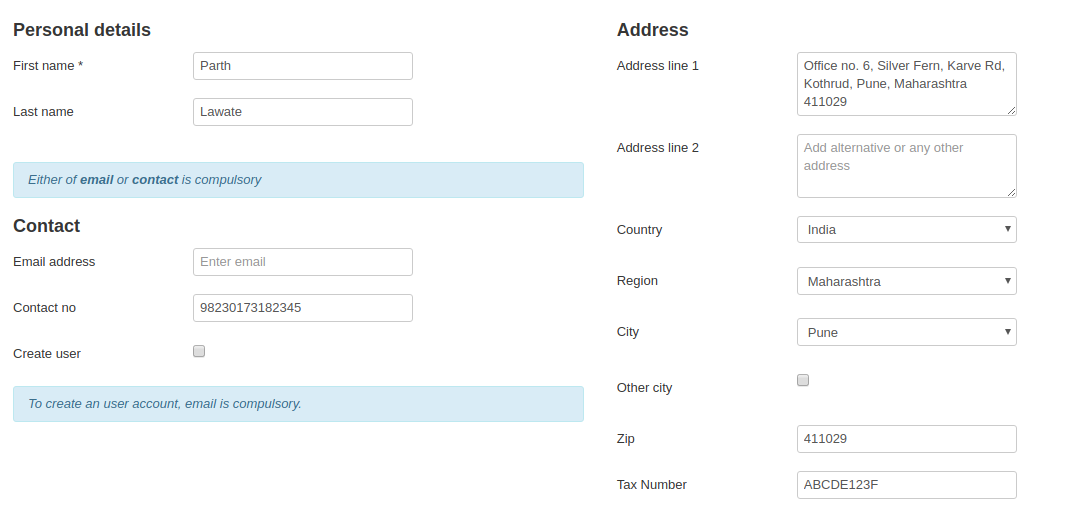

Individual donors

Using the donor data management feature, site administrators can now add the personal details, contact details and address details for individual donors. Individual donors and site administrators can now add the Tax number while filling the donation form. The tax number is vital for taxation purposes, especially where Donations can get tax benefits.

In the case of individual donors, both online donors and offline donors are added to the donor database.

In the case of online donors/investors, after successful donation/investment against a campaign on the website, the donor’s/investors entry will be added into the donor database. In the case of offline donors, the site administrator can update the donors' entry from the backend.

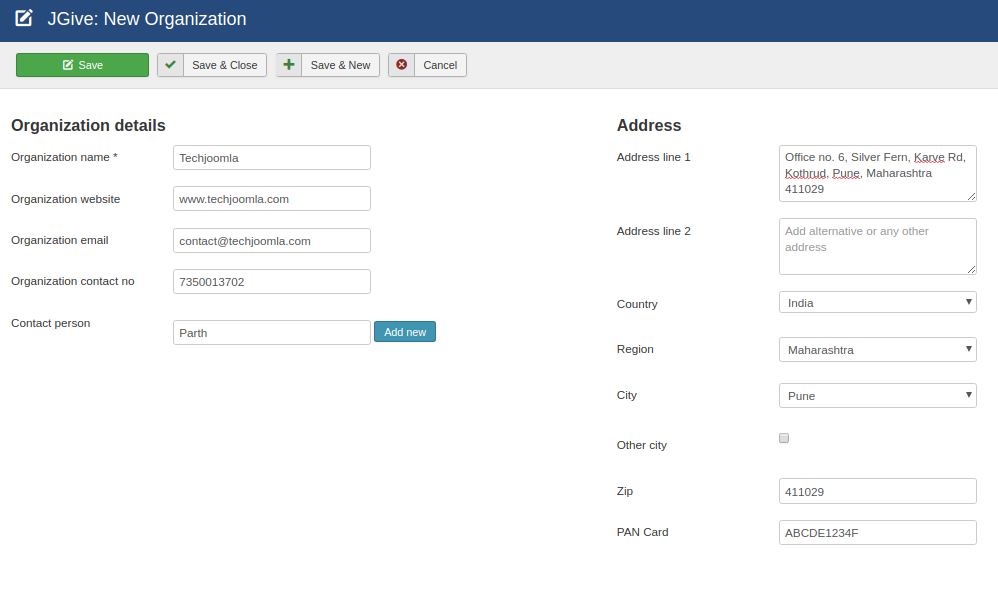

Organizational donors

From the backend, the Site administrator can add the organization details and address for organizations. A list of organizations with their contribution and contact information is displayed in the backend. Note that the organizational donors feature is only supported offline and the new organisational donation and organizational donor details can only be added by the site admin.

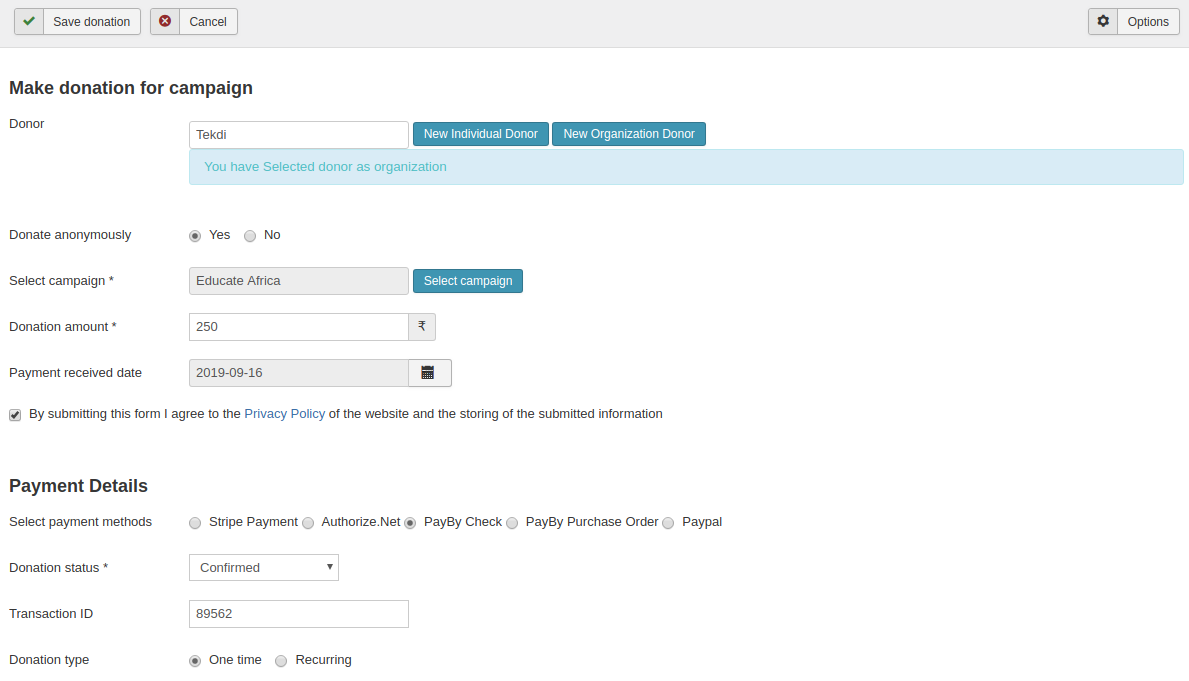

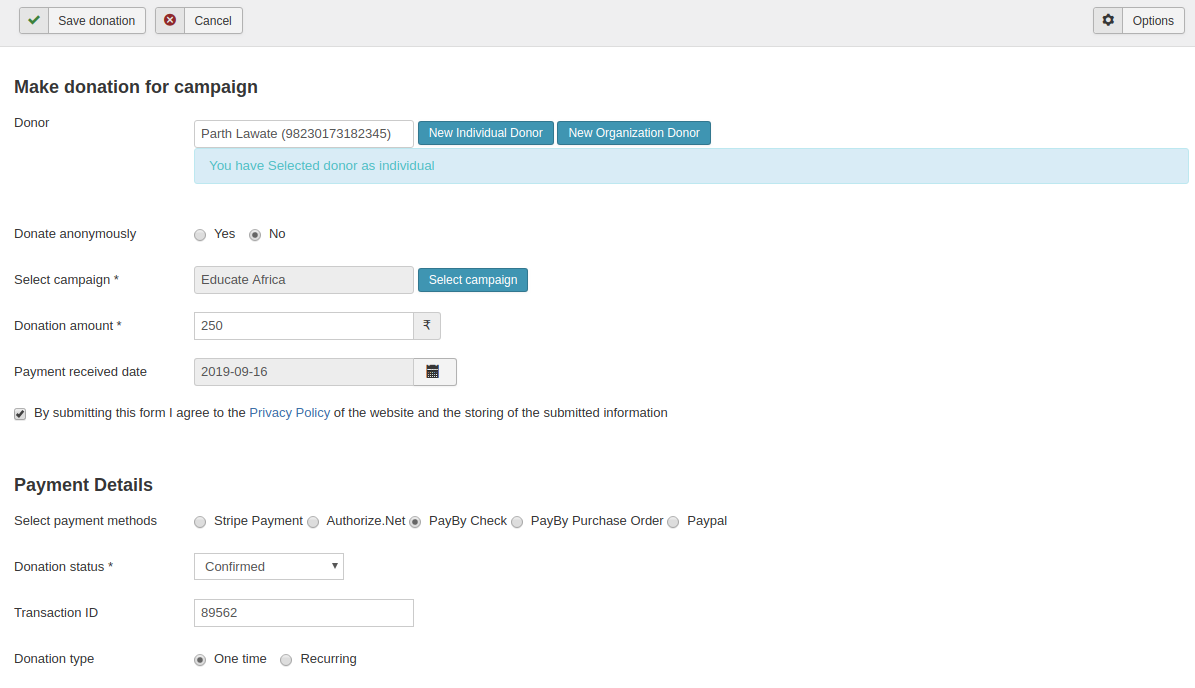

Revamped backend donation selection popup form for offline donations

By using the revamped popup, the site administrator will be able to select the users from Joomla users, registered individuals and organizations. The Site administrator will also be able to add user or organization if it does not exist through the popup. Donations can be placed from the backend as either individual or organization.

Placing donation for the donor as an organization

Placing donation for the donor as an individual

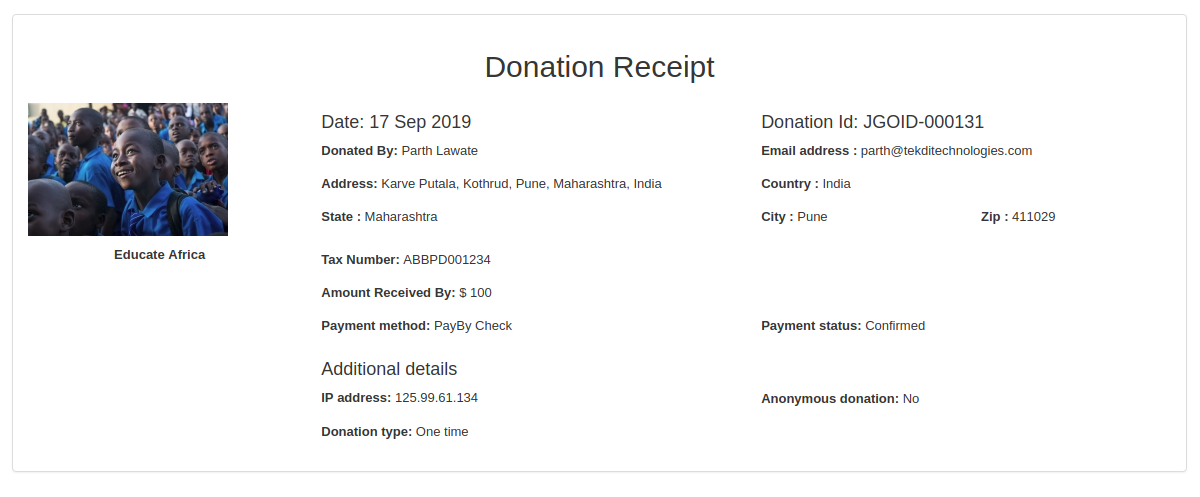

Print Donation receipt details page

Besides the donor data management feature, we have introduced the ability to print the donation receipt page.

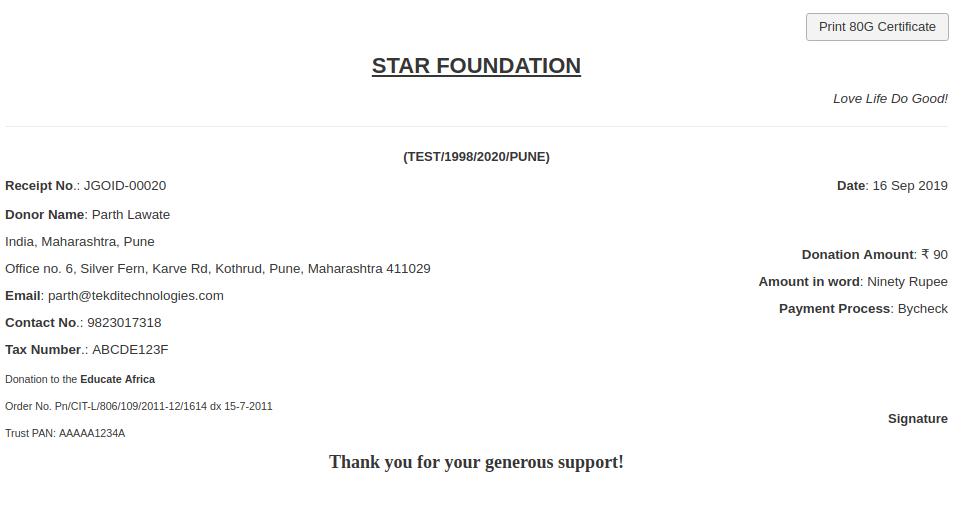

Print 80G Certificate

We have also introduced the feature to print an 80G certificate. In India, donations made to certain charities prescribed under category 80G are eligible for an 80G tax deduction. Similarly, donations made to charities are eligible for tax deductions in various other countries.

Donors Management Migration

We have introduced a new “Fix Database” button that will migrate the current database data as per the JGive 2.3 requirements.

Changelog

Feature

- 146164: Donor CRM-Organization and management of individual and organization data

- 146645: Feature to print the donation detail page and donation receipt

- 146160: Donors Management Migration - Existing donor data should not affect due to new functionality.

- 146643: Offline donation - Backend Donation Form

Task

- 149433: Added a new donation receipt template for donors to generate an 80G certificate.

Bug

- 149410: Security Fixes

- 140009: Default video is not set for campaign detail page

When you subscribe to the blog, we will send you an e-mail when there are new updates on the site so you wouldn't miss them.