You can set up two type of Taxation

- Item Level Taxation

- Same Percentage of Tax on the Purchase Price

1. Item Level Taxation

For this, Go to Quick2cart configuration ->Checkout tab and Enable shipping and tax as well as set it on item level

For item level mode, you have to enable Taxation - Default Zone based Taxation(tjtaxation) plugins and disable the Taxation to Quick2Cart(qtctax) plugins

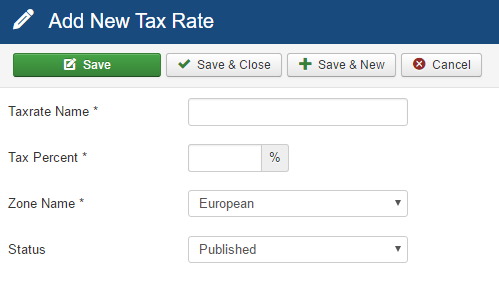

Create the Different Tax Rates

Depending on where you are , you might be liable to pay a variety of taxes. VAT, Service Tax, LBT, Sales tax etc are all examples of tax rates and they are a function of the Zone. You need to define all the applicable tax rates for each store for each zone that you ship to. VAT(Value Added Tax), LBT(Local Body Tax), Service tax etc are all examples of Tax rates and these will vary from region to region.

Setting up the Tax Rates is the first step you need to take to configure taxation. Setting up the Tax rate involves giving the Tax a Name, Defining the rate as a percentage & deciding which Zone it applies to.

To create tax rate, you should setup zone first. Multiple tax rates can be defined and assigned to different zones.

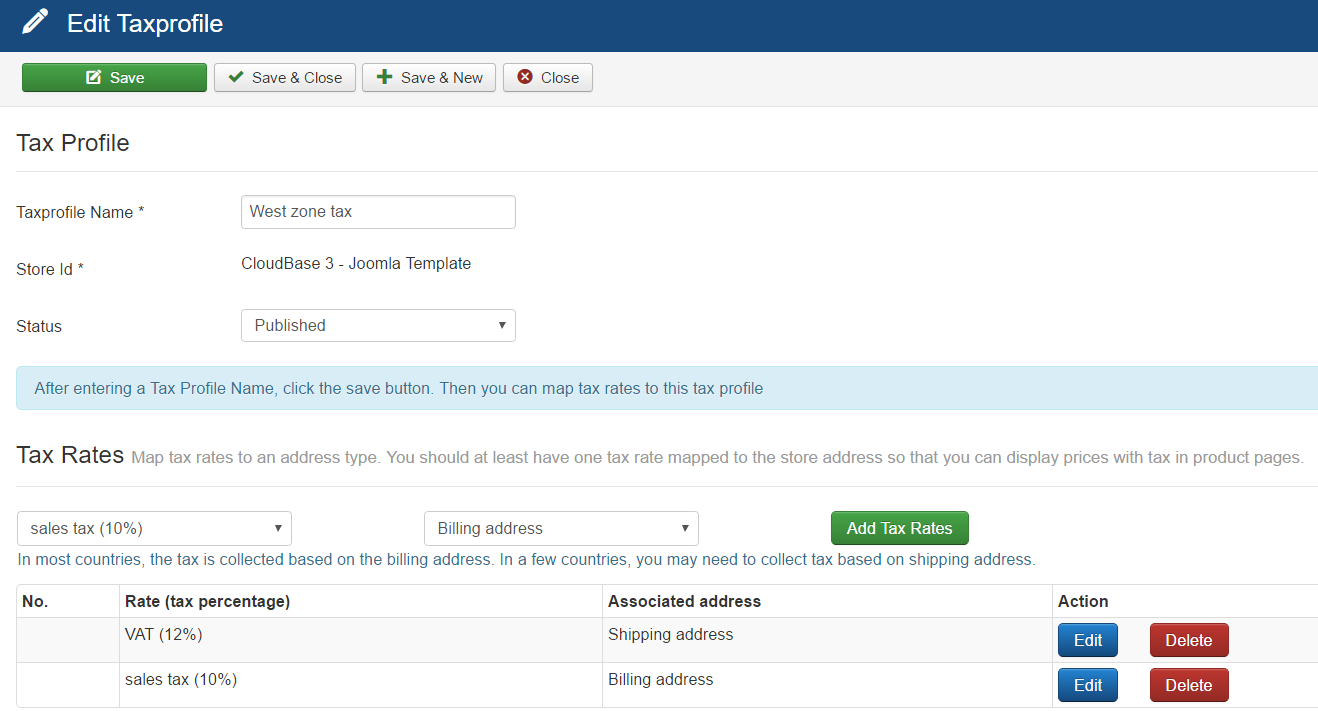

Tax Profile

Depending on what kind of product you sell, your product might attract multiple taxes. Tax Profiles make this easy to manage by allowing you to club tax rates together. Some taxes are based on the Billing Address while some might be based on the Shipping address. For instance in Pune (India), Soft drinks like Coke attract VAT. In case you are shipping to Pune from outside Pune, then they attract an additional Local Body Tax (LBT).

You can manage all these configurations easily by creating a Tax profile. In Tax Profile you need to give the Profile a name that's easy for your to associate with. Le'ts say 'Non Alcoholic Beverages' and again define which Zone it applies to. Once you have saved the profile, you can add multiple tax rates against the profile and also define which address each of the tax rate is based on. This completes the initial taxation setup.

To create tax profile, you should set-up tax rates first.

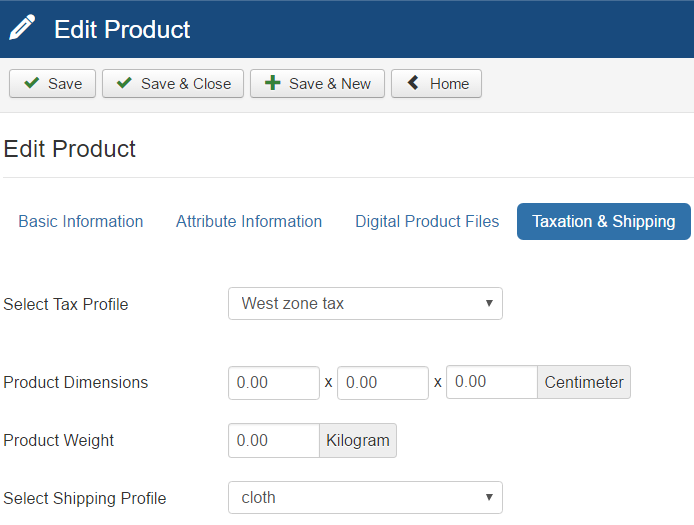

Add Tax Profile On Product

After creating the tax profile, you have to map the tax profile on product level

For this, Go to Quick2cart configuration ->Checkout tab and Enable shipping and tax as well as set it on Item Level

For Item Level mode, you have to enable Taxation - Default Zone based Taxation(tjtaxation) plugins and disable the Taxation to Quick2Cart(qtctax) plugins

1. Quick2cart configuration:- Enable shipping and tax as well as set it on item level

2. Create a product and click on save.

3. In the 4 tab set the Tax profile for the product.

2. Same Percentage of Tax on the Purchase Price

Very basic taxation support is provided via this taxation plugin.

For this,go to Quick2cart configuration ->Checkout tab and Enable shipping and tax as well as set it on Order Level and mode and enable the Taxation to Quick2Cart(qtctax) plugins and disable Taxation - Default Zone based Taxation(tjtaxation) plugins

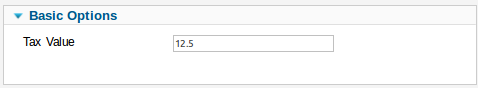

Configure this plugin:

- Go to plugin manager in backend.

- Find "Taxation to Quick2Cart" under "qtctax" type.

- In Basic options, in tax value parameter - the value entered will be considered in percentage, that will be applied on total price.

For developer: a developer API is also provided to write your own tax plugins.